(This does not effect employees on the URS Tier 1 plan or Tier 2 Defined Contribution plan)

You’ll be required to make a member contribution equal to 0.7% of your salary to fund your benefit in 2024-25.

You’ll be required to make a member contribution equal to 0.7% of your salary to fund your benefit in 2024-25.

As a member of the Tier 2 Public Employees System who has chosen the Hybrid Option, your employer pays the equivalent of 10% of your salary to fund your benefit.

If the yearly, actuarially determined cost to pay future benefits – the pension contribution rate – is less than 10%, you get the difference in the form of an employer-paid 401(k) contribution. This has been the case since the system was created by the Utah State Legislature in 2011.

The system was also designed so that if the pension contribution rate exceeds the employer contribution, the member must contribute from their paycheck to help fund the benefit.

*Effective July 2024, the pension contribution rate will increase into the range to require a member contribution equal to 0.7% of your salary.

This means you will have to pay a small amount from your paycheck to fund your Tier 2 Public Employee Hybrid Option benefit beginning July 2024. Your employer will automatically deduct this contribution each paycheck.

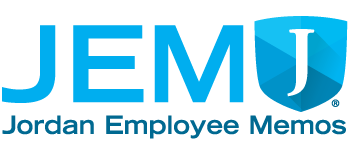

Example of What You’ll Pay Out-of-Pocket

These examples provide a perspective on how much you’ll contribute after-tax to help fund your benefit. Compare that small cost to the potential lifetime monthly benefit you could receive.

| Sample Salary | Amount deducted each paycheck if paid biweekly | Amount deducted each paycheck if paid monthly | For perspective, your potential lifetime monthly benefit* |

| $40,000 | $10.77 / biweekly | $23.33 / monthly | $1,750 monthly benefit |

| $60,000 | $16.15 / biweekly | $35 / monthly | $2,625 monthly benefit |

| $80,000 | $21.53 / biweekly | $46.67 / monthly | $3,500 monthly benefit |

*For illustrative purposes only. This example assumes a 35-year career and yearly 3% salary increase.

Who is impacted by this change?

This change applies to members in the Tier 2 Public Employees System in the Hybrid Option. You’re in the Tier 2 system if you were hired on or after July 1, 2011 without previous URS service credit. Check with your employer or log in to myURS at www.urs.org to find out which system is yours.

Your benefit is the Hybrid Option if you elected it, or were defaulted into it, after your 12-month decision period following your hire date. Because of state and federal law, you are unable to change your election after 12 months. Members who chose the 401(k) Option (Defined Contribution Plan) aren’t impacted.

What do I need to do to pay my contribution?

Nothing. Your employer will automatically deduct this contribution from your paycheck.

When will I begin contributing?

The 0.7% member contribution will be automatically deducted after-tax from your first paycheck on or after July 1, 2024. If you’re a school employee with a contract that starts September 1, the contribution will go into effect on your first paycheck after September 1, 2024.

Why are member contributions now required in my system?

This system was designed to require member contributions if costs to fund projected future benefits exceed a certain level. The projected costs have increased substantially recently, largely due to greater than expected salary increases among Utah public employees after 2020. Because the amount of your retirement benefit is tied to your salary, bigger raises will lead to larger monthly payouts in retirement. To ensure that your benefit is well-funded, URS, in consultation with our actuaries, increased the pension contribution rate (www.urs.org/rates) above the amount that employers are required to pay each pay period to fund your benefit. Contribution rates are re-evaluated yearly and may change from year-to-year, depending on the projected costs of future benefits. To better understand contribution rates and their impact on your retirement benefit, go to www.urs.org/rates.

Webinar

URS is offering a free webinar will explore how the Tier 2 system is designed to ensure adequate funding and why member contributions will be required.

June 13 at 10 a.m. | July 16 at 2 p.m.

Register at www.urs.org/ratesfaqs