Summer Professional Development Opportunities

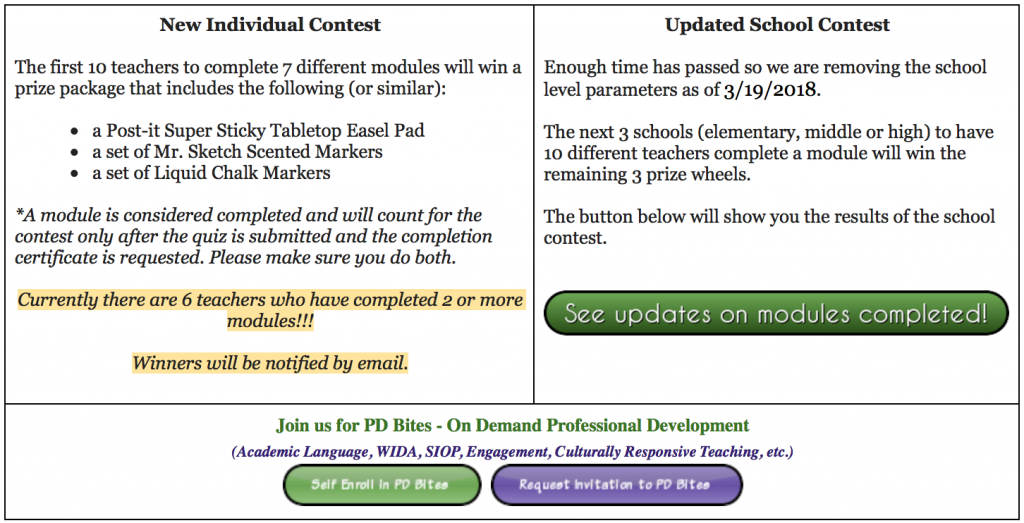

Online Professional Development Modules

Check out the 30-minute modules in the areas of academic language, English learners, culturally responsive teaching, engagement and more.

Win prizes for your school or for yourself for completing modules.

Please contact deborah.brey@jordandistrict.org with questions.

Year-End Processing Deadlines

Please review the following critical deadlines regarding the financial year-end processes for 2017-18. The dates could have a major effect on your location's ability to operate.

INVENTORY REQUISITIONS:

May 21, 2018 – Traditional Schools

Last day to enter and approve FY 2017-18 Inventory Requisitions (posted in current year), guaranteed delivery June 1, 2018.

May 25, 2018 – All Locations

First day to enter next year startup orders. Use FY 2018-19 to post in next year. Use FY 2017-18 to post in current year. Any Inventory Requisitions entered on or after May 25, 2018 to be delivered after July 1, 2018, should be entered as a FY 2018-19 Requisition.

June 1, 2018 – Traditional Schools

Last day for delivery of FY 2017-18 Inventory orders.

June 8, 2018 – All Locations

Last day to enter, and for Principals to approve, any FY 2017-18 Inventory Requisitions (posted in current year). Inventory Requisitions to be delivered by June 25, 2018.

June 25, 2018 – All Locations

Last delivery for all non-food FY 2017-18 Inventory orders.

July 3, 2018 – All Locations

Continue entering FY 2018-19 Inventory Requisitions. Warehouses resume delivery schedules.

PURCHASE REQUISITIONS: All Locations

April 13, 2018

All FY 2017-18 Purchase Requisitions using the Special Ed budget must be received by the Special Ed department.

May 1, 2018

All Purchase Requisitions estimated to be $50,000 or more must be routed to Purchasing.

May 18, 2018

Begin entering FY 2018-19 Purchase Requisitions. Select FY 2018-19 to post in next year. Use FY 2017-18 to post in current year. Please enter the respective year in the description field as seen below. FY 2017-18 Purchase Requisitions can be entered through June 8, 2018. All FY 2018-19 Purchase Requisitions will not be sent to vendors until after July 3, 2018.

June 6, 2018 – All Locations:

Last day for P-Card purchases for FY 2017-18.

June 8, 2018 - All Schools:

Last day to enter, and for Principals to approve, any FY 2017-18 Purchase Requisitions (posted in current year).

June 21, 2018

Last day for Administrator of Schools level approvals for FY 2017-18 Purchase Requisitions. Not guaranteed after this date.

July 3, 2018 - All locations:

Continue entering FY 2018-19 Purchase Requisitions.

ACCOUNTS PAYABLE:

Immediately

As always, Accounting needs “verification” of receipt of goods or services immediately after delivery. What constitutes a “verification” is: 1) a PO#, 2) a signature, 3) a date, and 4) an indication whether Accounting should keep the PO open (the PO has only partially been filled) or close the PO (all items received in full). The “verification” can be done on a packing slip, a copy of the PO, or a copy of the invoice.

Summer Product Received at Traditional Elementary Schools:

Purchased items being delivered by vendors and received at schools over the summer break must remain in a designated holding area. When staff returns they can account for the items properly, verify and submit the proper paperwork in a timely manner to the Accounting Department. This will help eliminate confusion between the schools and vendors on the whereabouts of items delivered.

May 18, 2018 - All Locations:

P-Card Reconciliations due in Accounting.

June 6, 2018 - All Locations:

Last day for P-Card expenditures for FY 2017-18.

June 7, 2018 - All Locations:

All items (mileage reimbursements, NPOs, check requests, Journal Entries and “verifications”) to be paid with FY 2017-18 budgets should be approved and received in Accounting by this date. Those received after this date, may be paid with FY 2018-19 budgets.

June 8, 2018 - Traditional Schools:

P-Card Reconciliations due in Accounting.

June 19, 2018 - Year-round schools and Departments:

P-Card Reconciliations due in Accounting.

June 27, 2018 - Elementary Schools:

Last day to submit Cash Receipts.

July 5, 2018 - All Locations:

FY 2017-18 Mileage Reimbursements Requests due, but if received after June 7, 2018, may be paid with FY 2018-19 budgets.

PAYROLL:

June 1, 2018 - Traditional Schools:

All True Time submissions due. Nutrition Managers approvals due by the end of the day.

June 4, 2018 - All Locations:

May Payroll due.

June 6, 2018 - All Locations:

True Time submissions due.

June 8, 2018 - All Locations:

True Time 1st approvals due.

June 11, 2018 - All Locations:

True Time final approvals due.

June 28, 2018 - All Locations:

Last day to enter FY 2017-18 Time Off.

June 29, 2018 - All Locations:

Any FY 2017-18 time off to be approved.

July 3, 2018 - All Locations: June Payroll due. Begin entering FY 2018-19 time off.

Year-round Schools:

True Time submissions due. Nutrition Managers approvals due by the end of the day.

July 5, 2018 - All Locations:

True Time Submissions due.

July 9, 2018 - All Locations:

True Time 1st approvals due.

July 11, 2018 - All Locations:

True Time final approvals due.

INSURANCE: All Locations:

May 23, 2018

Annual Question and Answer Sessions.

3:30 and 5:00 pm, ASB.

May 24, 2018

Annual Question and Answer Sessions.

5:00 pm, District Office.

June 13, 2018

Annual Health Fair, 3:30-5:30 pm, ASB.

Flyers and posters will be sent to all locations.

Any questions regarding deadlines, please contact either Kurt Prusse, Purchasing Director, 801-567-8701 or Michael Heaps, Information Systems Director, 801-567-8737

Fingerprinting and License Renewal for Teachers

Teachers needing to renew their license must be fingerprinted and begin the renewal process immediately to avoid contract termination. An authorization release form must be provided to HR when you arrive for your fingerprinting appointment. This form is available to print from the USBE website.

If you have any question contact Stacy (801) 567-8221 or Jill (801) 567-8227 in HR for more information.

Check Your Federal Tax Withholding

The Jordan School District Payroll Department encourages everyone to use the IRS' Withholding Calculator to perform a quick “paycheck checkup.” This is even more important this year because of recent changes to the tax law for 2018.

The Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck at work.

There are several reasons to check your withholding:

- Checking your withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year.

- With the average refund topping $2,800, you may prefer to have less tax withheld up front and receive more in your paychecks.

If you are an employee, the Withholding Calculator helps you determine whether you need to give your employer a new Form W-4, Employee's Withholding Allowance Certificate. You can use your results from the Calculator to help fill out the form and adjust your income tax withholding.

Pi Day Offer From Village Inn Restaurants

Village Inn Restaurants would like to help educators celebrate Pi Day with fun activity ideas for the classroom and discounts on pie for students, teachers and staff.

Internet Safety Presentation

Student Intervention Services is hosting a presentation focusing on the work of ICAC, the Internet Crimes Against Children Task Force.

Student Intervention Services is hosting a presentation focusing on the work of ICAC, the Internet Crimes Against Children Task Force.

All JSD administrators and parents are invited to attend.

The event will be held on March 8, 2018 from 6 – 7 p.m. in the auditorium of the Jordan School District Auxiliary Services Building.

Be Well Newsletter

Skyward Down For Maintenance

Skyward will not be available during a system upgrade from 9 p.m. Friday, February 16 until 12:00 noon on Saturday, February 17.

This will affect both Student and Fianance systems including Family Access and Employee Access.

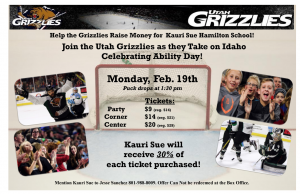

Discount Tickets Available for Utah Grizzlies Game on February 19th

The Utah Grizzlies celebrate Ability Day with Jordan School District on Monday, February 19!

The puck drops at 1:30 p.m. as the Grizzlies battle the Idaho Steelheads in a key ECHL Mountain Division match-up.

All Jordan School District employees can receive a discount on tickets for this game. Best of all, the Kauri Sue Hamilton School will receive a donation from the Grizzlies from each ticket purchased in support of the school.

IMPORTANT - You must call (801) 988-8009 and mention the Kauri Sue Hamilton School to purchase your discount tickets and for the school to receive a donation from your tickets.

Teacher Transfer Fair Coming February 20th

The Teacher Transfer Fair is open to all current Jordan School District teachers. It is a chance to explore all of your options in a no pressure, no obligation environment.

The Teacher Transfer Fair is open to all current Jordan School District teachers. It is a chance to explore all of your options in a no pressure, no obligation environment.

Bring resumes, references and ID badge.

- ELEMENTARY

- February 20, 2018, 4:30 – 6:00 p.m. - Columbia Elementary School, 7800 S. 3505 West, West Jordan

- SECONDARY

- February 20, 2018, 4:00 – 5:30 p.m. - Elk Ridge Middle School, 9800 S. 3659 West, South Jordan

Employee Assistance Program

Jordan School District provides employees with short-term, confidential counseling through Blomquist-Hale. The Employee Assistance Program (EAP) can be used by you and anyone else in your household at no out-of-pocket expense to you.

Jordan School District provides employees with short-term, confidential counseling through Blomquist-Hale. The Employee Assistance Program (EAP) can be used by you and anyone else in your household at no out-of-pocket expense to you.

Services provided include marital and family counseling, stress/anxiety/depression counseling, assistance with financial or legal problems, and coping with grief and loss.

The services are 100% confidential and are offered at convenient locations throughout the area.

For more information or to schedule an appointment call (800) 926-9619 or visit the Blomquist-Hale website.

Welcome to JEM!

Welcome to JEM, the brand new Jordan Employee Memo!

JEM is an electronic newsletter for all District employees aimed at providing time sensitive information regarding Jordan School District employment. JEM is a resource for employees to better understand District policies and be informed about important deadlines. We hope to provide information that will help employees keep up on crucial issues that impact their employment.

JEM will be emailed to all employees monthly.

Tax Withholding for 2018 Is Changing

The IRS said it expects to issue initial guidance on new withholding tables for payroll systems in January 2018, "which would allow taxpayers to begin seeing the benefits of the change as early as February."

The IRS said it expects to issue initial guidance on new withholding tables for payroll systems in January 2018, "which would allow taxpayers to begin seeing the benefits of the change as early as February."

Many employees may need to file new W-4 forms, but it isn’t clear when new ones will be ready.

"We are taking the initial steps to prepare guidance on withholding for 2018," the IRS said in a statement shortly before the congressional vote. The IRS also said it "will be working closely with the nation's payroll and tax professional community during this process." The IRS encourages wage earners to review their tax withholdings.

"By adjusting the Form W-4, Employee's Withholding Allowance Certificate, taxpayers can ensure that the right amount is taken out of their pay throughout the year," the IRS advised. "Having the correct amount withheld from paychecks helps to ensure that taxpayers don't pay too much tax during the year—and that they have money upfront rather than waiting for a bigger refund after filing their tax return."

Please mail your adjusted W-4 form to Payroll through the U.S. Postal Service or drop it off in person to the Payroll Department at the District Office.

The level of income that is subject to a higher tax bracket also can influence a number of decisions by employees, including how much salary to defer into retirement savings plan. __________________________________________________________________________________ Retirement Savings Plan Annual Contribution Limits

Pre-Tax Contributions (withdrawals taxed as income during retirement)

$18,500 *401(k), 403(b), 457

$24,500 Can contribute an additional $6,000 for age 50+

*401(k) and 403(b) plans share a combined annual limit 457 plan is treated as separate from the 401(k)/403(b) limits

After-Tax Contributions – may be tax deductible (withdrawals taxed as income during retirement)

$5,500 Traditional IRA

$6,500 Can contribute an additional $1,000 for age 50+

After-Tax Contributions (withdrawals are tax-free during retirement)

$5,500 Roth IRA

$6,500 Can contribute an additional $1,000 for age 50+

All of the above plans are available as a payroll deduction, and they are all with Utah Retirement Systems (URS), with the exception of the 403(b) plan. You may obtain information and/or forms by logging in to www.urs.org, or by contacting the Payroll Department. The 403(b) provider list and contact information is available on the Payroll Department’s website.

________________________________________________________________________________

$128,400 Social Security Wage Base ________________________________________________________________________________

Health Savings Account (HSA) Annual Contribution Limits (under qualified plans)

$3,450 Single Medical Coverage

$4,450 Can contribute an additional $1,000 for age 55+

$6,900 Family Medical Coverage

$7,900 Can contribute an additional $1,000 for age 55+

Teacher Transfer Fair

The Teacher Transfer Fair is open to all current Jordan School District teachers. It is a chance to explore all of your options in a no pressure, no obligation environment. Please take note of the dates, which have changed this year.

The Teacher Transfer Fair is open to all current Jordan School District teachers. It is a chance to explore all of your options in a no pressure, no obligation environment. Please take note of the dates, which have changed this year.

Bring resumes, references and ID badge.

ELEMENTARY

- February 20, 2018, 4:30 – 6:00 p.m. - Columbia Elementary School, 7800 S. 3505 West, West Jordan

SECONDARY

- February 20, 2018, 4:00 – 5:30 p.m. - Elk Ridge Middle School, 9800 S. 3659 West, South Jordan

Watch Out for Fraudulent Emails

Dear Employees,

We would like you to please be mindful of fraudulent emails.

We would like you to please be mindful of fraudulent emails.

When opening emails from unknown sources, you could fall victim to phishing attacks aimed at stealing your personal information. Hackers often use keywords like “sales giveaway” or “package delivery notification.” These emails may contain malicious clickable links designed to misdirect you to fake sites where attackers can steal your personal information.

Please remember that Jordan School District will not send emails requesting your login name or password.

Thank you.